The Rise of AI budgeting apps in Personal Finance

For years, Canadians have relied on spreadsheets, notebooks, or basic apps to manage their money. But in 2025 and 2026, a new trend is reshaping the way people track spending and save: AI budgeting apps.

These tools don’t just record your expenses — they learn from your behaviour. They analyze your spending habits, categorize your purchases automatically, and even predict future bills and savings opportunities.

What Are AI Budgeting Apps?

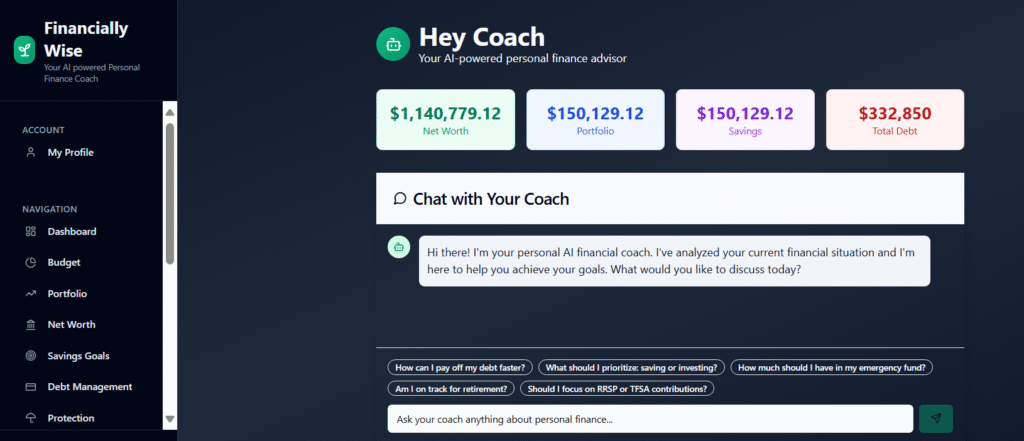

AI budgeting apps use machine learning and data analytics to give you personalized financial insights. At first, you manually enter in your financial standing like your individual investment accounts, chequing, savings, and even all of your debts.

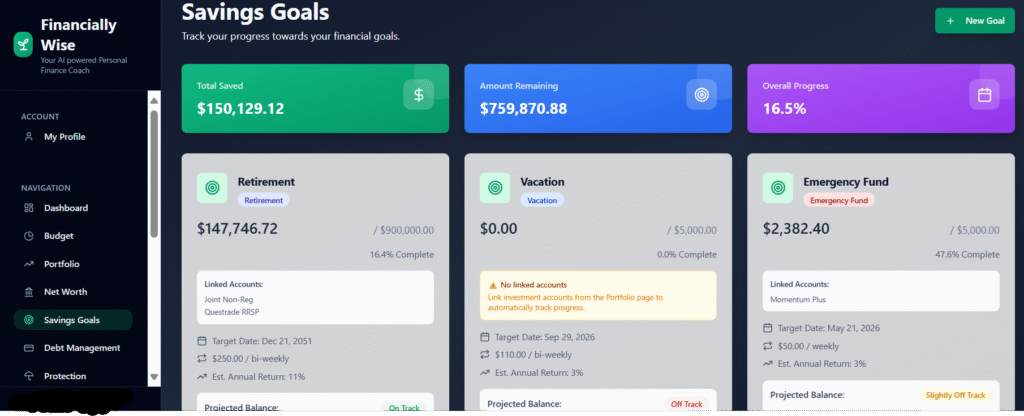

The AI budgeting app at FinanciallyWise.AI will review your financial data, and make recommendations on how to improve. You can also enter the financial goals you want to achieve like buying a home, paying down debt, saving for retirement, and it will come up with a saving or debt pay down strategy for you.

This is smart budgeting.

Traditional vs AI Budgeting

| Feature | Traditional Tools | AI-Based Tools |

|---|---|---|

| Expense tracking | Manual entry | Automatic categorization |

| Budget setup | Fixed templates | Dynamic, adaptive budgets |

| Insights | Basic charts | Predictive analytics |

| User experience | Reactive | Proactive |

| Recommendations | Generic | Personalized to your habits |

How AI budgeting apps Work

Here’s what happens behind the scenes when you use an AI-powered tool like FinanciallyWise.ai:

- Complete your profile

Enter your occupation, income, and family members you are financially responsible for (important if 1 of your financial goal is children’s education) - Create a budget

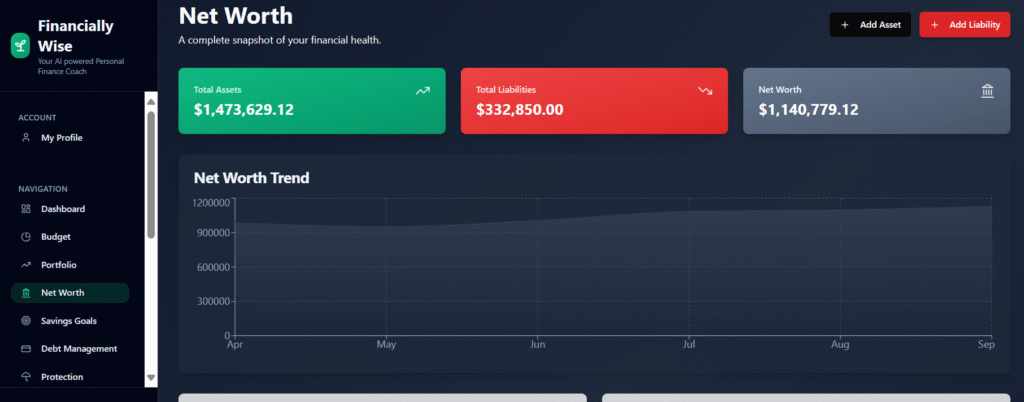

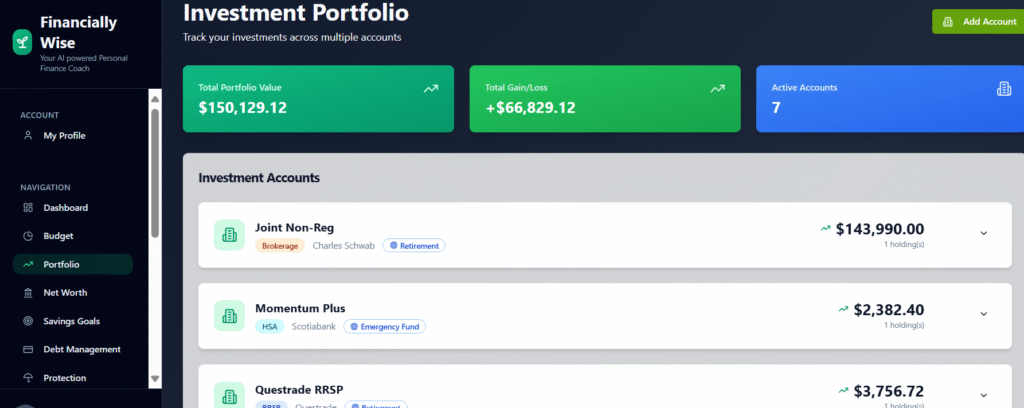

List your income sources and your expenses. - Assets

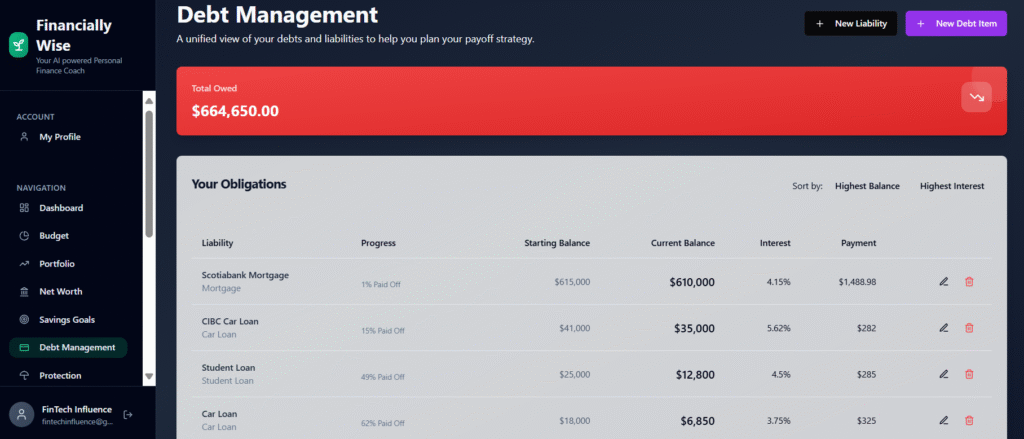

List your assets – savings, investments, property values, vehicles…etc. - Liabilities

Enter your debts – loans, line of credit balances, credit card balances, mortgage balances…etc. Enter the payments and interest rates to get better analytics of your finances. - Goals

Enter your financial desires – buying a home, paying off debts, savings goals, retirement goals…etc. - Protection

Enter the amount and type of insurance you have – life insurance, critical illness, disability insurance…etc. - Personalized Insights

Ask you AI Financial Coach what you can do to better your finances. Or “I’m getting a $5000 bonus at work” what should I do with it? - If you are a DIY investor, you’ll get access to their investment portfolios to see what the team at FinancialWise is holding.

Why Canadians Are Turning to AI Budgeting Apps

According to Finder Canada (2025), over 38% of Canadians now use some form of financial app. Of those, more than 60% say automation helps them save more consistently.

Key Benefits:

- Time savings: No manual data entry — the app does the heavy lifting.

- Accuracy: Reduces human error and categorization mistakes.

- Personalization: Adapts to your lifestyle, not the other way around.

- Accountability: Provides real-time notifications when you’re off track.

- Motivation: Visual progress tracking keeps you engaged with your goals.

How FinanciallyWise.ai Helps You Budget Smarter

Unlike generic apps, FinanciallyWise.ai is built specifically for Canadians — with a focus on local financial institutions, CAD currency, and Canadian tax and expense categories.

Core Features You’ll Love:

✅ AI-Powered Spending Insights

✅ Goal Tracking

✅ Cash Flow Forecasting

✅ Budget

✅ Ask your AI Financial coach questions,

Top AI budgeting apps for Canadians (2025)

If you’re exploring your options, here are the top AI-based budgeting apps worth considering:

| App | Key Feature | Free Plan | Canadian-Focused |

|---|---|---|---|

| FinanciallyWise.ai | Goal Tracking, Budgeting, Ai Financial Coach | ✅ Yes | Yes |

| Monarch Money | Custom budget categories | ✅ Yes | ❌ No |

| YNAB | Goal tracking | ❌ No | ❌ No |

| PocketSmith | Timeline forecasting | ✅ Yes | ⚠️ Limited |

| Mint (ending soon) | Expense tracking | ✅ Yes | ⚠️ U.S.-centric |

Are AI Budgeting apps Safe?

Absolutely — provided you use reputable, encrypted tools.

FinanciallyWise.ai uses bank-grade encryption (256-bit) and never stores your banking credentials.

The Future of AI and Money Management

With tools like FinanciallyWise.ai, you’re not just budgeting — you’re building a personalized, data-driven financial strategy.

Final Thoughts

AI budgeting apps are no longer just “nice-to-haves.” They’re becoming essential financial companions for Canadians who want clarity, control, and confidence in their money decisions.

If you’re ready to move beyond spreadsheets and start saving smarter, try FinanciallyWise.ai — a Canadian-built budgeting app that uses AI to make personal finance simple.